the second time in a row, the Reserve Bank on Thursday reiterated that leaving the key rates and the stance unchanged “is not a pivot but only a pause” and that future policy actions will purely be data-dependent as a durable fall in inflation is still a long way.

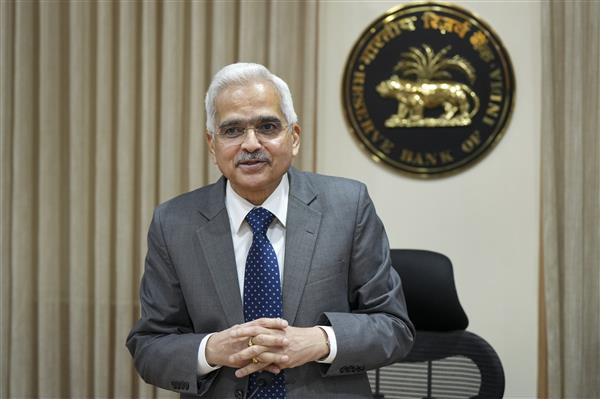

Earlier in the day, the RBI governor-led rate-setting panel unanimously left the repo rate unchanged at 6.50 per cent and maintained that they will continue to work towards withdrawing policy accommodation.

Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain. Our goal is to achieve the inflation target of 4 per cent in a durable manner and not just keeping inflation within the comfort band of 2-6 per cent,” Das told reporters at a post-policy presser.

I wish to emphasise that we will do whatever is necessary to ensure that long-term inflation expectations remain firmly anchored. The Reserve Bank will remain watchful and proactive in dealing with emerging risks to price and financial stability”.

“Therefore, given the uncertainties, we need to maintain ‘Arjuna’s eye’ on the evolving inflation scenario. Let me re-emphasise that headline inflation still remains above the target and being within the tolerance band is not enough. Our goal is to achieve the target of 4 per cent, going forward,” the governor said, adding it is always the last leg of the journey that’s the toughest.

His deputy and the head of the monetary policy department at the central bank, Michael Patra said the policy stance and inflation forecast for the year wherein they expect the prices index to hover around 5.1 per cent for the year, the impact of the MSP hike for paddy (10-12 bps) and the likely impact of the El Nino on the monsoon are factored in.

This forecast, it can be noted is a marginal improvement from the April forecast, when it had projected the prices to average at 5.2 per cent during FY24.

Retail inflation fell sharply to 4.7 per cent in April from 6.4 per cent in , on the of favourable base effects, with softening observed across all the three major groups. In March, it fell to 5.67 per cent from 7.79 per cent

Credit : https://www.tribuneindia.com/news/business/we-are-only-pausing-on-rates-too-early-to-call-on- inflation-fight-rbi-governor-shaktikanta-das-515358